Employee Security Awareness Training Protects Your Business

Here are some eye-opening statistics regarding employees and cyberattacks:

2 min read

Heather Trone Jul 14, 2021 8:00:00 AM

The amount of data breaches, ransomware and other cyberattacks occurring today has never been higher. Businesses need to consider cyber liability insurance, no matter what size their business is. Companies need to protect themselves from cyberattacks. Cyber liability insurance provides a safety net in place in case of an attack. These insurance policies are critical for businesses that collect or handle sensitive information such as payment card information, personally identifiable information or protected health information.

The amount of data breaches, ransomware and other cyberattacks occurring today has never been higher. Businesses need to consider cyber liability insurance, no matter what size their business is. Companies need to protect themselves from cyberattacks. Cyber liability insurance provides a safety net in place in case of an attack. These insurance policies are critical for businesses that collect or handle sensitive information such as payment card information, personally identifiable information or protected health information.

In the past, cyber liability insurance was reasonably easy to obtain. When renewals came up, your coverage was re-upped for another year if you didn't have a significant business change. Due to the large number of threats that exist, cyber liability insurance providers require businesses to have multi-factor authentication (MFA) in place before they even provide a quote. If your business doesn't have MFA, the risk of non-renewal or a considerable hike in premiums now will prevent companies from getting coverage.

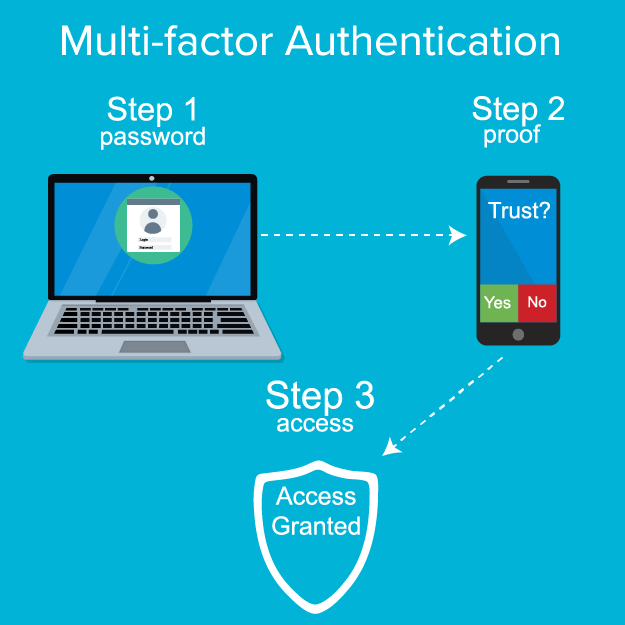

Multi-factor authentication is a security measure that forces users to provide multiple credentials to verify their identity before gaining access to a network or system. In most instances, users give a login and password and then verify their credentials by inputting a code sent to them at another device or confirming access with something like a fingerprint. This sort of technology has been in place for several years with banking and health information. Still, now most companies conducting business have some form of multi-factor authentication in place. While multi-factor authentication can require users to perform an extra step at login, the protection it provides is worth the effort.

Multi-factor authentication protects against the following types of cyberattacks:

According to Microsoft, multi-factor authentication adds a layer of security that can block upwards of 99.9% of attacks arising from compromised accounts. Consider that a phishing attack may give hackers a user's credentials to systems, but with MFA, they cannot provide the security question response required for authentication.

Multi-factor authentication is a relatively simple security measure to put in place. If you have an in-house IT staff, the solution is relatively easy to employ. Without IT staff, a reputable Managed IT Services provider can help your business handle it with ease. The cost of multi-factor authentication can be as little as $3 per user, per month, but that cost can vary based on the type of solution selected and the number of systems and accounts protected by the solution.

Multi-factor authentication provides a strong layer of protection for businesses to prevent cyber attacks. Insurance companies know how effective these solutions are, and it is now why they are requiring them to provide cyber liability insurance. It only takes one compromised business credential to cause a data breach, and 60% of companies that suffer a cyber attack close their doors within six months due to an inability to recover. Be prepared and protect your business. It's not a matter of if but when a cyber attack will occur.

Here are some eye-opening statistics regarding employees and cyberattacks:

Cyber incidents happen, on average, every 39 seconds! By the time I finish typing this next sentence, another one happened. With the alarming...

Do you know how much printing costs your business each year? Any idea how to find out? Despite the fact that much of the way we conduct business...